Tips You can Trust: Smart Disaster Giving, Appreciated Stock, and Supporting Charities through the Sale of a Business

Greetings from the Wyoming Community Foundation!

Fall is upon us, and philanthropy is on the minds of many. That’s not only because you and other attorneys, accountants, and financial advisors frequently start year-end planning for your clients in September, but it’s also because charitable individuals and families are looking closely at their charitable giving goals and budgets for the year. They are already setting in motion the gifts they want to make before 2023 winds down. And of course, during this year’s giving season, philanthropy will surely be on the minds of many because of the tremendous community needs in the wake of recent natural disasters.

The Wyoming Community Foundation (WYCF) is here to assist you as you guide your clients in executing their philanthropy plans for the remainder of 2023. In that spirit, we’d love to draw your attention to three important topics:

Giving to Relief Efforts

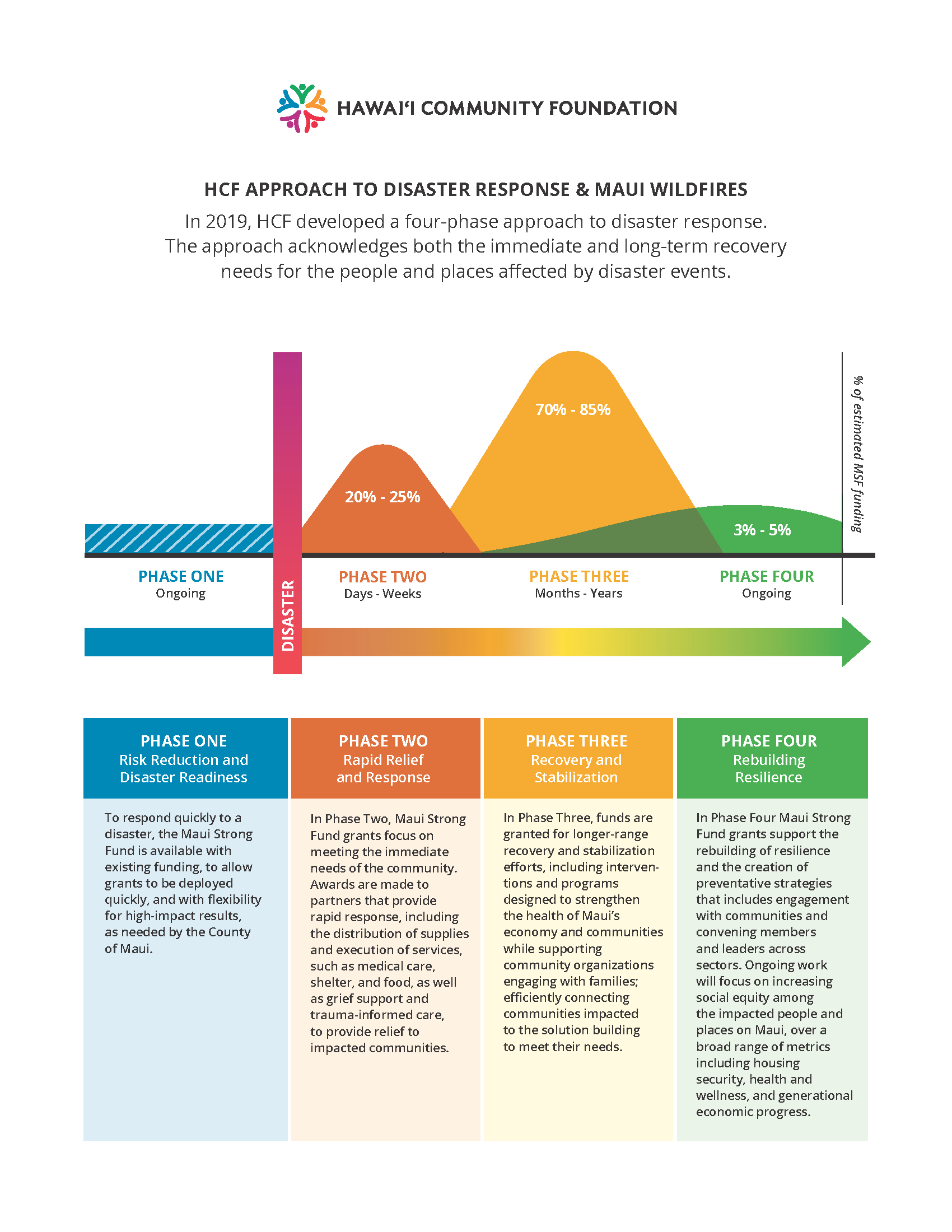

Your clients might not realize that charitable giving support is not only needed immediately following a disaster such as a hurricane or fire but is also needed on an ongoing basis as communities rebuild over the long term. Lean on WYCF to help you work with your clients to structure gifts to provide relief and support for the people of Maui affected by the fires and the people impacted by Hurricane Idalia. Indeed, community foundations are an important “first responder” to help ensure that charitable support is facilitated efficiently and effectively and is deployed as fast as possible to the people who need it most–and over time as rebuilding and recovery efforts persist for years.

The Power of Appreciated Stock

We just can’t say this enough! Attorneys, accountants, and financial advisors like you are well aware of the tremendous benefits your clients get when they give appreciated stock, instead of cash, to their donor-advised funds at WYCF. Unfortunately, the message often does not get through to clients. A regular reminder from you is so important to ensure that your clients are maximizing their charitable giving dollars to not only support their favorite causes, but also to optimize their own financial plans. Despite the rocky stock market, many stocks are way up in 2023.

Business Sale on the Horizon?

Your clients who own businesses might be eyeing some analysts’ predictions that mergers and acquisitions may pick back up in 2024. That’s good news for clients who are looking at possible exit strategies. If these clients are charitable, though, start talking about it now. Gifting shares of closely-held businesses to a fund at WYCF is a brilliant strategy, but you must think way ahead to avoid running afoul of IRS rules. The Wyoming Community Foundation can help.

As always, we appreciate the opportunity to work with you and your clients!

–Your Wyoming Community Foundation

Smart Disaster Giving Can Offer Predictability to the Unpredictable

Unfortunately, rarely does a month go by without the news of another disaster or humanitarian tragedy. Most recently, the Maui fires and Hurricane Idalia are making the headlines–and are also generating widespread charitable support. Indeed, many of your clients are no doubt supporting relief efforts through monetary donations.

Disasters are both unpredictable yet, sadly, predictable. Multi-billion-dollar damage events occur on an annual basis and (not surprisingly but thankfully!) these natural disasters and humanitarian tragedies consistently attract much-needed philanthropic support.

Most of the charitable dollars following a disaster flow toward essential and immediate relief efforts. Your clients might be interested to know, however, that dollars for efforts related to rebuilding and future mitigation are also critically important. Affected communities need both immediate philanthropic support for people affected by a disaster and long-term support to address ongoing ramifications. Ongoing support, for example, is needed not only for rebuilding after a fire or hurricane, but also to fund preparedness to blunt the effects of the next fire, hurricane, or pandemic.

The team at the Wyoming Community Foundation is happy to work with you and your charitable clients to explore ways to address future humanitarian disasters. Many people, for instance, use their donor-advised funds at WYCF to support disaster relief efforts. And with rebuilds and recoveries often occurring over the long-term, a bunching strategy could help clients support disaster relief efforts through their donor-advised funds for several years. This allows clients to plan to provide support in advance, while also being smart about the tax advantages in the year of the transfer to their donor-advised fund.

This graphic from the Hawai’i Community Foundation (HCF) illustrates the importance of ongoing support to communities effected by disasters. The approach acknowledges both the immediate and long-term recovery needs for the people and places affected by disaster events.

[Click to enlarge the image]

Not limited to disaster responsiveness, WYCF is an ideal partner for disaster preparedness. Encourage your clients to consider endowments, field-of-interest funds, designated funds, and other perpetual structures established through the Wyoming Community Foundation to ensure that the community we love is protected for generations to come. Field-of-interest or unrestricted funds can be especially attractive because, for people who’ve reached the age of 70 ½, these funds are eligible recipients of QCDs (Qualified Charitable Distributions) from IRAs. Creating a field-of-interest or unrestricted fund allows a client to make charitable gifts in advance of disasters so that WYCF can deploy resources immediately when urgent needs occur.

As disasters and hardships across the country inevitably occur, the WYCF team is honored to serve as a valuable resource to help you help your clients deploy the power of philanthropy to those who need it most.

Keep Your Eye on Clients’ Appreciated Stock–ALWAYS

Such a difference a year makes…maybe!?

By August 2022, markets were down 12% for the year and inflation was up 8.3% year-over-year. Perhaps consequently, but then unknown, annual charitable giving was on its way to a rare (fourth time in 40 years) year-over year decline of some 4% according to Giving USA. This decline was due in part to donors not wanting to give stock at depressed values. You likely even discussed this with your clients!

Nearly 12 months later, as of July 2023, markets were up 7.28% year to date and inflation was roughly half at 4.7% year–over-year. Even though the stock market still shows signs of volatility, we are hopeful that charitable giving will rebound.

Even in down markets or times of high inflation, some stocks will outperform. These holdings are of course excellent candidates for your clients to give to charity and avoid taxes the capital gains. This year is no different, with stocks like Microsoft, Apple, Nvidia, and many others enjoying banner years. Indeed, Microsoft, Apple, and Nvidia were up 38%, 36% and 228%, respectively through mid-August. For some of your clients, these gains have created concentrated stock positions where you, as an advisor, may believe that portfolio allocations have become imbalanced under the investment strategy you are pursuing. Your clients who support charities through their donor-advised funds at WYCF can consider potentially alleviating this situation through charitable gifts of highly-appreciated stock.

Your clients who give appreciated stock to a donor-advised fund can:

-

- Enjoy the ease of the donor-advised fund as an account for current and future charitable giving

- Conveniently support the causes they and their families care most about

- Maintain a mix of assets in the donor-advised fund account that are consistent with the client’s investment philosophies

- Benefit from an up-front income tax deduction, avoid capital gains on the assets’ sale within the fund, and grow the proceeds for future grantmaking

- Leave a legacy for children and grandchildren to continue their philanthropic commitments

- Reduce the value of their taxable estate, potentially reducing estate taxes

- Comply with IRS charitable gifting guidelines

- Enjoy supporting charities in the client’s name, the fund’s name, or anonymously

- Receive a single year-end tax document that summarizes all gifts for tax purposes

By establishing a donor-advised fund at WYCF, your client is part of a community of giving and will have opportunities to collaborate with other donors who share their interests. In addition, your client is supported in strategic grant making, family philanthropy, and opportunities to gain deep knowledge about local issues and nonprofits making a difference.

Family Philanthropic Legacies

The Curt Gowdy Family Fund supports Curt Gowdy’s vision as well as his surviving family’s philanthropic goals at the state park. Most recently, his daughter Cheryl Gowdy utilized the fund to open the Little House on the Park initiative.

So, while it’s nice to see the market’s performance improve, a bonus opportunity lies in your clients’ transferring appreciated stock to donor-advised funds at the Wyoming Community Foundation. We are here to help!

For Clients Who May Sell a Business, the Time to Think Charitably is Right Now

Business owners who’ve enjoyed summertime’s more relaxed energy can deservedly daydream about the “extended vacation” that comes with selling the business!

Business owners who’ve enjoyed summertime’s more relaxed energy can deservedly daydream about the “extended vacation” that comes with selling the business!

While it all sounds good, business brokers will tell you that many business owners fail to optimize—and they sometimes even compromise—the value of their business’s proceeds by rushing the process, hastily determining an asking price or not fully assessing the value of their business to a potential buyer. In their haste, owners often miss strategies that can deliver an improved post-sale result and a true reward for their years of work.

The Wyoming Community Foundation can be a valuable resource as you guide a business owner client through a pre-sale preparation process. This is especially true for a business that has operated for many years and has accumulated significant unrealized capital gains in its valuation that are likely to be heavily taxed at the time of the sale.

Many closely-held business owners and their advisors may not be fully aware of the advantages of giving shares to a donor-advised fund at WYCF well in advance of any external discussion about a potential sale of the business. With prudent planning, the gifted shares will be free of capital gains at sale time, allowing the proceeds to flow into the donor-advised fund, ready to be deployed to meet the business owner’s charitable goals. The business owner also benefits because they’ve reduced the value of their taxable estate. This can have huge repercussions given the anticipated reduction of the estate tax exemption slated for 2025.

Remember that it will be important to secure a proper valuation of the business at the time the business owner makes a gift of shares in order to comply with IRS requirements for documenting the value of the charitable deduction.

Critically important to successfully executing this strategy is ensuring that your client avoids even any preliminary discussions about sale, let alone negotiations, before consulting with advisors, including looping in WYCF early on. Otherwise, your client might get caught in the IRS’s step-transaction trap, a risk with any pre-sale gift to charity of real estate, closely-held stock, or other alternative asset. The devil is in the details!

By the way, if you routinely advise owners of closely-held businesses, and if you like to go deep into tax law, you might enjoy reviewing the issues related to the business itself supporting charitable causes, totally unrelated to its eventual sale.

Please reach out to the Wyoming Community Foundation team if a business owner client would like to explore the idea of potentially giving a portion of the business to a donor-advised fund or other type of fund at WYCF. We can work alongside you and the client to help optimize the exit and maximize the resulting proceeds.

The team at the Wyoming Community Foundation is a resource and sounding board as you serve your philanthropic clients. We understand the charitable side of the equation and are happy to serve as a secondary source as you manage the primary relationship with your clients. This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.