What You Need to Know About Property Taxes

Taxes are how we pool resources to pay for K-12 education and the many services provided by our county and town governments that we depend on.

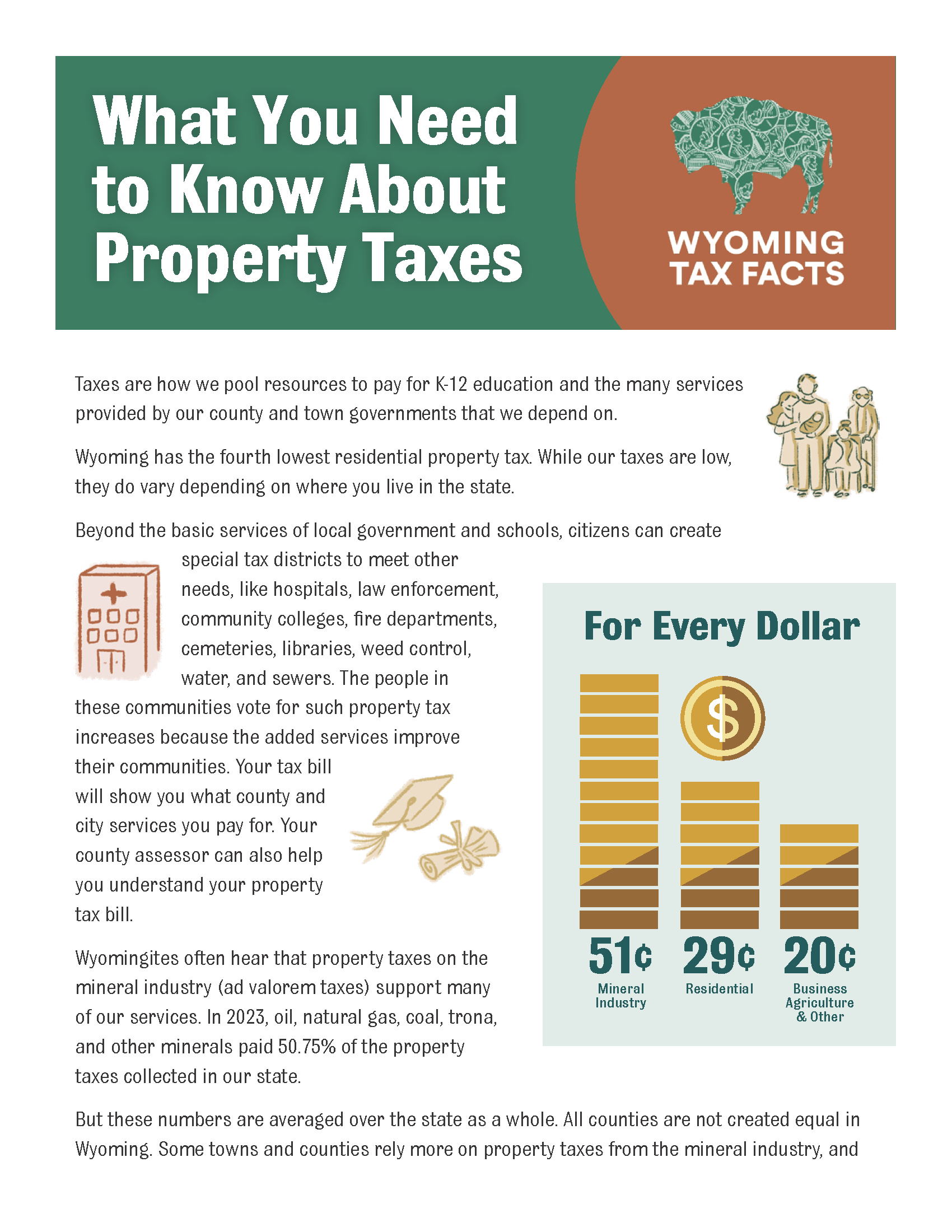

Wyoming has the fourth lowest residential property tax. While our taxes are low, they do vary depending on where you live in the state.

The Wyoming Community Foundation and Wyoming Tax Facts have produced this flyer that is a helpful refresher on the services your Wyoming property taxes help support.

Feel free to use this guide yourself or share with others who might find this useful.

For a more in depth look at Wyoming’s tax landscape, watch:

Wyoming’s Taxes Determine Wyoming’s Future: A Conversation with Gov. Dave Freudenthal and Wyoming Senator Cale Case (Recorded January 31, 2024)

As you think about proposed changes to property taxes, take time to consider the value of supporting your own community.

For information sources and more Wyoming Tax Facts visit wyomingtaxfacts.org