Tips You Can Trust: Supporting Your Charitable Clients’ Wishes and Building Community

Generational Impact, WYCF as Your Hub for Giving, Tax Legislation Updates

Updates from Rachel Bailey, Director of Philanthropy, for March 2025

Hello from the WYCF Development Team!

Here we are, right in the middle of another tax season. The years go by so quickly! Of course, preparing clients’ tax returns and planning for the year ahead are top of mind for attorneys, CPAs, and financial advisors.

Our team is happy to share three updates that might help you navigate your work with charitable clients over the next few weeks & beyond.

Here’s what’s been trending with advisors recently.

- The transfer of wealth is real, and it is upon us! Discover how WYCF can help you engage your clients in meaningful conversations about their charitable wishes. Now is the time to set philanthropy plans in motion.

- Local issues are top of mind for many of your clients. The Wyoming Community Foundation is uniquely positioned to help your clients make the biggest difference in the areas of our community’s greatest needs while also helping your clients support the full range of their charitable interests.

- If you have a hard time keeping up with pending legislative changes that could impact your clients’ charitable giving plans, you are not alone! Our expert staff are here to keep you and other attorneys, CPAs, and financial advisors up-to-date on how ever-evolving tax laws may shape philanthropy.

It is our honor and pleasure to work with you and your clients. Thank you for partnering with the Wyoming Community Foundation. We wish you all the best in the coming weeks!

–Your friends in philanthropy, WYCF

Generational Impact: Fulfill Clients’ Charitable Wishes and Build Community

Chances are, you’ve already begun to notice that a major transfer of wealth is happening as your Baby Boomer clients establish financial and estate plans to pass their wealth to their Gen X and Millennial children.

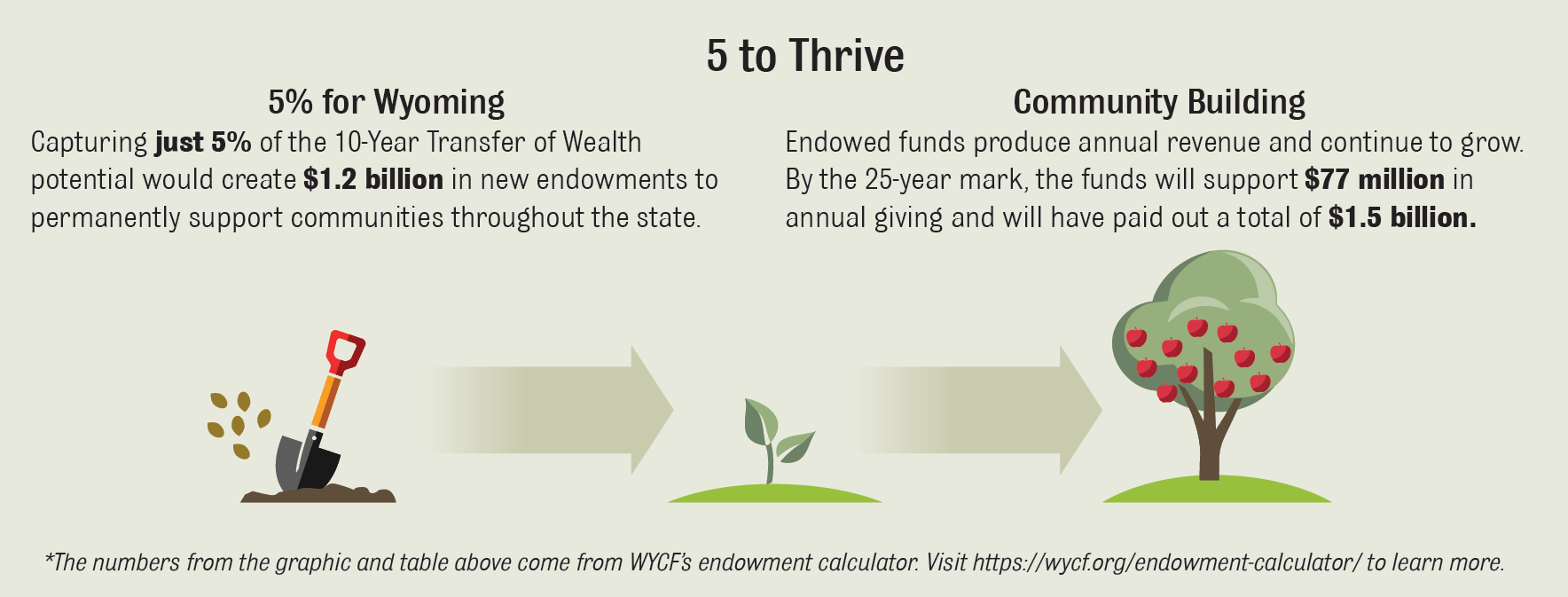

We here at the Wyoming Community Foundation have noticed it too, which is why we released the Wyoming Transfer of Wealth in 2024. The dollars involved are eye-popping. In Wyoming, an estimated $24 billion will transfer from one generation to the next by 2034.

The state of Wyoming, as a whole, has over $173 billion dollars in household wealth. While wealth will continue to transfer from parents to children, the next 10 years are crucial particularly in rural states where inherited wealth tends to leave the state. Once wealth leaves our communities, this opportunity leaves with it. Additionally, charitable investing through planned giving takes time. Planning for the future for our families and communities is an important step in creating stability in our state.

The time is now to build a culture of philanthropy in Wyoming. Clients can leave 95% of their wealth to those they love, and 5% to causes they care about.

As the transfer of wealth gains momentum, advisors have a major opportunity to position themselves as trusted experts who can help clients not only structure efficient lifetime and estate gifts to heirs, but also help ensure that clients’ charitable wishes are achieved. It’s crucial for advisors to know that WYCF is here to help incorporate philanthropy into clients’ financial and estate plans.

Here’s why this is so important:

-

- There’s a knowledge gap. Clients may not be aware of the options and benefits of charitable planning. Even many of your affluent clients may still be writing checks to their favorite charities, not realizing that gifts of appreciated stock, for example, can be more tax-efficient, and that our tools at WYCF, such as donor-advised funds, can be incredibly useful.

- Next-level strategies are key. Your ultra-wealthy clients will likely need to implement sophisticated strategies for transferring assets smoothly and tax-efficiently. Clients want to maximize the results of their charitable gifts while also protecting their families’ interests. Leaning on the community foundation to help structure gifts of complex assets, such as closely-held business interests, can make a huge difference in reducing a client’s tax bill and achieving meaningful community impact.

- Legacy planning starts now. It’s tempting to put off addressing a client’s wishes to support favorite charities in an estate plan. “We’ll look at that in a few years,” is a common but less-than-ideal approach. That’s because charitable bequests are best addressed as part of a comprehensive estate and financial plan. Naming a fund at the Wyoming Community Foundation as the beneficiary of a client’s IRA, for example, is an extremely tax-efficient way to accomplish charitable wishes.

Our team is here to be your partner in charitable giving strategies. Not only will you be better able to meet clients’ needs, but you’ll also strengthen relationships and improve client retention. Please reach out to learn more about how WYCF can help your clients make a lasting impact with their wealth while achieving their financial goals.

For Clients Who Love Local Causes, WYCF is the Place

The Curt Gowdy Family Fund at WYCF supports outdoor recreation, the arts, and education among other donor interests.

Most of your philanthropic clients likely support a wide variety of charities year after year. The causes they support represent a range of motivations, including personal experience, a role as a volunteer or board member, family tradition, or alignment with values and community priorities.

Many of the charitable organizations your clients support are local. That’s important to note because it means that your clients are especially well-positioned to lean into the Wyoming Community Foundation’s unique position as the hub for charitable giving and local knowledge. Here are three reasons that matters:

1. Clients can tap into the team’s knowledge about specific organizations, including financial information, data about the impact of a charity’s programs, and observations of an organization’s areas of greatest need.

One thing I love about working with WYCF is that the staff know the nonprofits that are healthy and the ones that aren’t. I know I can trust the community foundation’s guidance on what is a smart investment for my fund.

2. Clients can choose from a variety of fund types depending on what they’d like to achieve. A designated fund, for example, allows your client to set aside tax-deductible dollars that are dedicated to supporting a specific organization. Through WYCF’s services, funds are distributed over time to the charity while the assets remaining in the fund are protected from the charity’s creditors. Another example is an unrestricted fund, which leverages our team’s extensive research about the needs of the community and the nonprofit programs that are addressing those needs.

3. Clients can work with the Wyoming Community Foundation to leave a bequest to an endowment fund to support community needs for generations to come. As a perpetual organization, our staff ensures that charitable giving stays strong in our state to address important needs as they evolve over time.

Of course, if your client establishes a donor-advised fund with WYCF, the fund can support local causes as well as causes across the country. As the hub for your clients’ charitable giving, our tools and our team are dedicated to helping your clients achieve their charitable goals both near and far. Working with the Wyoming Community Foundation, no matter what a particular client’s charitable priorities may be, is itself a strong show of support for philanthropy right here in your community.

It’s a Full-time Job! Keep Up with the Ever-Evolving Tax Legislation

Many attorneys, CPAs, and financial advisors regularly ask the our staff to provide a refresher course on the potential tax changes on the horizon in 2025, especially those that might impact charitable planning techniques.

Here’s a quick rundown of three things you need to know:

-

- Sunsetting provisions of the Tax Cuts and Jobs Act of 2017. The TCJA’s scheduled expiration at the end of 2025 will revert key tax policies to pre-2017 levels, potentially affecting charitable giving incentives. For example, the top individual tax rate is scheduled for a bump from 37% to 39.6%, potentially increasing the benefits of charitable tax deductions for your high-income clients. At the same time, the limit for cash donations to public charities is slated to drop from 60% of AGI to 50%, reducing the deduction for some of your clients. Finally, the estate tax exemption is scheduled to drop to approximately $7 million per individual. Because the exemption would nearly be cut in half, and therefore more estates would be subject to tax, a larger subset of your clients could benefit from charitable bequests to avoid estate tax. All of this assumes, of course, that intervening legislation won’t prevent the sunset.

-

- Potential expansion of charitable deduction. Proposals like the Charitable Act aim to introduce a universal deduction for non-itemizers, broadening tax incentives for your clients across income levels. The bill is still popular among industry leaders and appears to have maintained momentum since it was introduced.

-

- Consequences remain to be seen. Above all, the 2025 “cliff” may trigger the first major tax code rewrite in decades, which in turn surely would have a ripple effect in many areas of your clients’ lives, including within the charities your clients support. Post-TCJA, for example, charitable giving dropped by as much as $20 billion, according to one study, in the wake of reduced tax benefits.

The bottom line here is that we’ve got you! The team at the Wyoming Community Foundation stays on top of legal developments at the intersection of tax policy and charitable giving. We keep our fingers on the pulse of potential implications for you, your clients, and the charities they support, and we are here to help you navigate the changes.

The team at the Wyoming Community Foundation is a resource and sounding board as you serve your philanthropic clients. We understand the charitable side of the equation and are happy to serve as a secondary source as you manage the primary relationship with your clients. This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.

Like what you've seen? Sign up to read more!

The Wyoming Community Foundation publishes our charitable giving e-newsletter once a quarter. Read it on our blog OR get it sent directly to your e-mail.