Tips You can Trust: “Catch Up” contributions to boost IRA philanthropy

Hello from the Wyoming Community Foundation!

It’s summer 2023 and there’s no shortage of news on topics related to philanthropy and charitable giving. This month we are drawing attention to IRAs. And down below we are sharing some of the amazing upcoming opportunities for professional advisors to attend all across the state.

If you are not talking about philanthropy with your clients, we really, really, really encourage you to do so! It is good for your clients, good for the community, and good for you, too. Please lean on the team at the Wyoming Community Foundation. We are here to help you with any and all charitable giving issues that might cross your desk.

Happy summer, and stay cool!

– Your Wyoming Community Foundation

How “catch-up” contributions can boost clients’ giving

At the community foundation, we regularly work with legal, financial, and tax advisors like you to help clients reach their charitable goals.

This month we’re focusing on the ever-popular subject of using IRAs for charitable giving. We just can’t say enough about the power of the IRA to supercharge your clients’ charitable giving.

From a charitable giving perspective, the greater the IRA balance, the more opportunity there is for a client to give later to a fund at the community foundation. If your clients are 70 ½, you simply must take a close look at the QCD, which your clients can use to fund a designated, unrestricted, or field-of-interest fund at the community foundation.

And never, ever forget the eye-popping effectiveness of a client naming their community foundation fund as the beneficiary of an IRA, especially when the client has pumped up the IRA’s value through catch-up contributions.

All in all, IRAs are the most prolific retirement savings vehicle in the United States, accounting for nearly 33% of the $33 trillion of total retirement assets as of December 2022. But regardless of the retirement savings vehicle, contribution maximization—and aided by so-called catch-up contributions—is a winning strategy for wealth building, family gifting, and charitable giving.

Upcoming events for YOU

Professional Advisor Estate Planning Breakfasts

Professional Advisor Estate Planning Breakfasts

-

- Presented by WYCF’s CFO, Misty Gehle, and Director of Philanthropy, Jerrica Becken

- Breakfast is complimentary. This is a non-solicitation event.

- Please RSVP to Madeline at (307)760-0203

Sublette Local Board

Wednesday August 9th, 7:30 AM

Bison’s Bounty | 21 N. Franklin Ave., Pinedale

Rock Springs

Thursday August 10th, 7:00 AM

Western Wyoming Community College – Room 3650A | 2500 College Dr., Rock Springs

Evanston

Thursday August 17th, 7:00 AM

The Beeman – Cashin Building | 35 10th St., Evanston

Charitable Giving Seminar

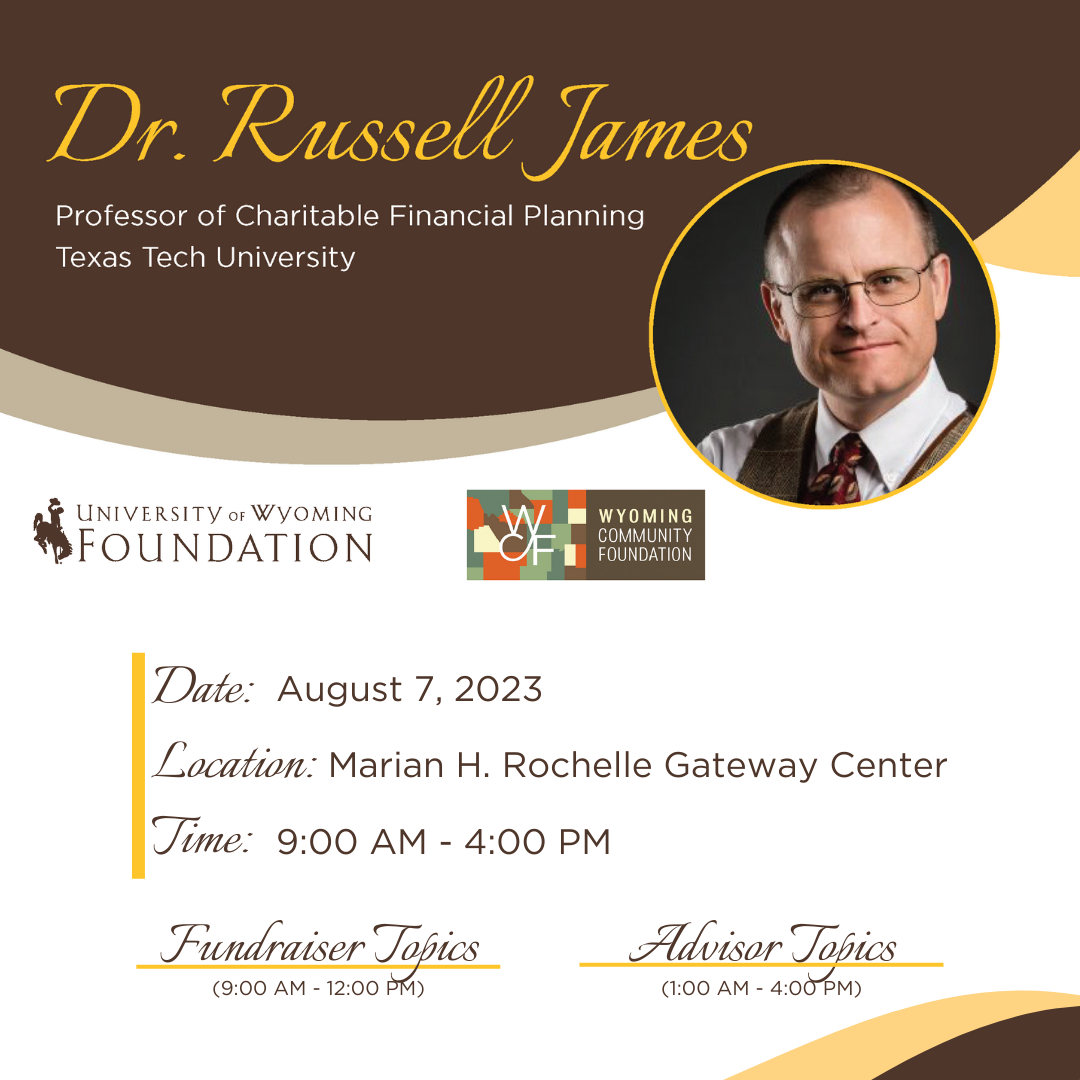

August 7th | Laramie, WY

Join the University of Wyoming Foundation and the Wyoming Community Foundation for a seminar on charitable giving with Dr. Russell James, Professor of Charitable Financial Planning at Texas Tech University, on Monday, August 7th, from 9:00 am to 4:00 pm at the Marian H. Rochelle Gateway Center. See more here.

Save the Date: Wyoming State Bar Convention – feat. WYCF sponsored speaker Barry Nickelsberg

September 8th | Laramie, WY

-

- How to broach philanthropy with clients who are preparing their wills and trusts

- How to remain relevant through philanthropy: What wisdom do your clients wish to pass along to future generations?

- Philanthropic vehicles to help your clients reach their charitable goals

We hope to see you soon!

The team at the Wyoming Community Foundation is a resource and sounding board as you serve your philanthropic clients. We understand the charitable side of the equation and are happy to serve as a secondary source as you manage the primary relationship with your clients. This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.